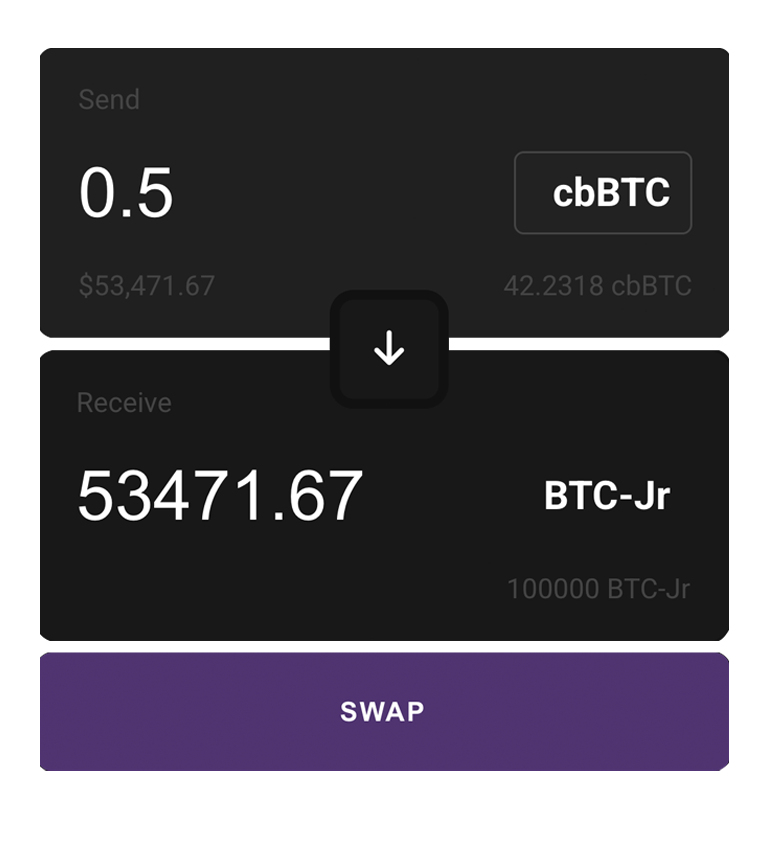

Swap cbBTC for BTC-Jr to get 1.33x exposure, hold without risk of liquidations, swap back whenever you want.

Bet on direction, not timing. Today's leveraged ETFs are immensely popular, but they're not designed to be held for more than a day. This puts pressure on users to perfectly time markets. Fragments offers advanced exposure that's safe to hold for medium to long periods of time, beginning with Bitcoin.

| Simple | Leveraged | Holdable | Transparent | |

|---|---|---|---|---|

| BTC Junior | Yes | Yes | Yes | Yes |

| Leveraged ETFs | Yes | Yes | No | No |

You don’t need to be a professional trader to use BTC-Jr. Just swap cbBTC for it and swap back whenever. No margin, strikes, or maturities.

At 1.33x volatility, BTC-Jr offers just enough leverage that its holders can outperform Bitcoin without the stress.

No liquidations. BTC-Jr utilizes perpetual tranching which means there's no need to babysit positions or perfectly time markets.

The leverage multiplier is the amount of performance magnification offered over the performace of an underlying asset. If the quoted multiplier is 1.33x this means gains and losses are magnified by 33%.

Tranching is a common practice in traditional finance that broadly refers to the process of dividing a larger financial asset into smaller portions (tranches).

In the case of Fragments specifically, tranching refers to the process of reorganizing the volatiliy of an underlying asset (cbBTC) into higher volatiliy (BTC-Jr) and lower volatiliy (BTC-Sr) assets.

For an overview see the how it works page.

Liquidation is the forced, automatic closure of a trader's leveraged position (often at market bottoms) when the holders position falls below the required minimum threshold. This action is taken to cover outstanding debts and prevent the account balance from going negative.

This is generally undesired because the position is entirely forfeit thereafter. Unlike a typical drawdown, the losses are locked in and there is no chance of value recovery.

Leveraged ETFs are not suitable for long-term investing due to compounding losses from operational financing fees and the volatility drag effect. Fragments derivatives like BTC-Jr can be held for much longer periods of time due to efficiencies arising from lower leverage multiples and zero intermediary fees.

There are a number of differences. Fragments derivatives are zero liquidation, easy to use, and much more efficient. The market for long positions in perpetual futures depends on a corresponding market for shorts. Because short positions are risky to hold, demand for shorts is highly variable and expensive to fund. As a result the cost of leverage is high.

Junior positions produced by Fragments on the otherhand (the equivalent to longs) are supported by corresponding stable yield positions (seniors), rather than shorts. Demand for stable yields is highly predictable, available, and comparatively cheap to fund. For this reason, the cost of holding leverage in Fragments is considerably lower and positions can be held for much longer.

The Fragments plaform was designed to produce easy-to-use leverage products that are suitable for buy-and-hold investors. 1.33x leverage offers "just enough" magnification of an underlying asset's gains and losses, to outperform in a long-run upwards market without the stress.

BTC-Sr is a stable derivative of cbBTC; it is the natural counterpart to BTC-Jr. Where the junior asset benefits from magnified volatility, the senior benefits from insulated volatility. Moreover, BTC-Sr automatically carries a yield arising from demand for leverage (BTC-Jr). To learn more see the BTC Senior page.

The "Balancing Rate" is a bidirectional interest rate designed to keep the system in balance. When demand for BTC-Jr is higher interest is paid to holders of BTC-Sr and vice versa. To learn more see the how it works page.

The Fragments protocol utilizes dynamic entrance and exit fees. These are non-extractive fees that are paid to holders of the junior (BTC-Jr). They serve to encourage balance and bidirectional liquidity in the system.

When the system is in balance there are no entrance and exit fees. When the system is out of balance, fees are charged when a given swap further pushes the system out of balance.

Additionally, there is an optional protocol fee in the system, set to 0% at launch. When turned on, the balance of protocol fees will be governed, owned, and secured by a platform governance token.