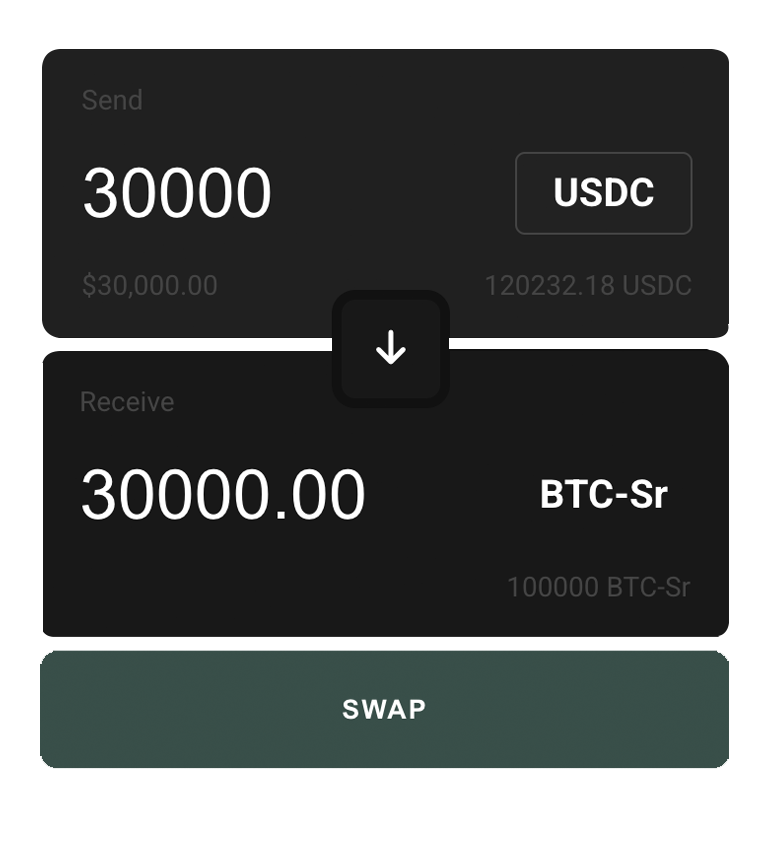

Swap USDC for BTC-Sr — a Bitcoin-backed stable asset that automatically carries yield. Swap back whenever you want.

BTC-Sr is a stable derivative of cbBTC; it is the natural counterpart to BTC-Jr. Where the junior asset benefits from magnified volatility, the senior benefits from insulated volatility. Moreover, BTC-Sr automatically carries a yield arising from demand for leverage (BTC-Jr). For a brief system overview see the how it works page.

Ethena's staked USDe product harvests imbalances in demand between short and long ETH positions. BTC-Sr similarly harvests imbalances in demand, except in our case it's imbalances between stable and long positions in the Fragments ecosystem.

Note — Because it is significantly cheaper to incentivize holding stable positions than short positions, BTC-Sr is more efficient at harvesting the yield arising from demand for leverage. Given equal costs of leverage, BTC-Sr generates higher yields.